Esta nota está basada en varios artículos de “The Economist” de noviembre 01 2025. Las gráficas vienen del mismo ejemplar.

New York City faces a fundamental economic challenge: the decline of its financial sector and the erosion of the tax base that has long funded its generous welfare state. This transformation has coincided with the rise of Zohran Mamdani, a 34-year-old Democratic Socialist poised to become the city’s next mayor, offering an expensive progressive agenda to address the crisis.

The Decline of Finance

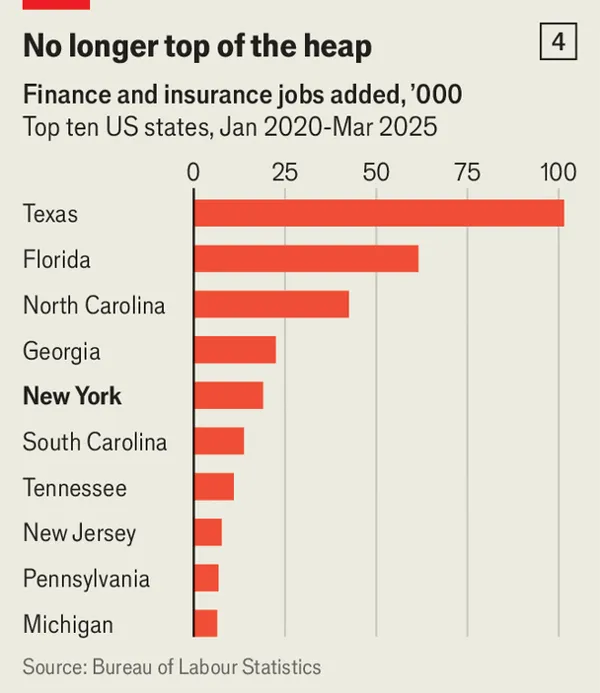

For more than two centuries, New York has been the nation’s financial center, but this pre-eminence is slipping. The share of workers employed in finance and insurance has fallen from 11.5% in 1990 to 7.7% in August 2025. Of the 233,000 finance jobs created in America over the past five years, New York secured only around 19,000—behind Texas, Florida, North Carolina, and Georgia. Financial firms are cutting costs by relocating to cheaper cities: Goldman Sachs has nudged managers to Dallas and Salt Lake City, Morgan Stanley is now the largest employer in Alpharetta, Georgia, and Citigroup is expanding in Charlotte, North Carolina.

High costs and heavy taxes explain much of this exodus. New York’s state corporate income tax of 7.25% is reasonable, but the city adds its own corporate tax plus a levy for regional transport, leaving some businesses paying more than 18% in local taxes alone. Exacting local regulations—such as rules requiring independent audits for AI tools or restrictions on asking about criminal history—further burden firms. Educated workers have also gravitated elsewhere, with graduates multiplying faster in Miami, Dallas, Charlotte, and Austin than in the New York metropolitan area.

The ultra-wealthy have been particularly mobile. Paul Singer and Carl Icahn, founders of major investment firms, have relocated to Florida. New York state’s share of taxpayers reporting over $1 million in income declined from 12.7% in 2010 to 8.7% in 2022. Goldman Sachs estimates that 10% of households in New York City with incomes exceeding $10 million established residency elsewhere between 2018 and 2023. Those high earners paid $34 billion in income tax to the state and city in 2022—a figure that would have been $13 billion higher if New York’s share of millionaires had held steady.

A Shifting Economy

As finance has declined, job growth has concentrated in lower-paid industries. Since the end of 2019, New York has added more than 268,000 jobs in health care and social assistance, particularly home health care. The city’s employment would have actually shrunk without this growth. This shift is visible in wage growth: while hourly wages in the private sector have risen about 3% across the country since January 2020 (adjusted for inflation), they have dropped 9% in New York City.

Tech offers some hope. Employment in the tech industry in New York City rose 64% between 2014 and 2024. Alphabet opened a campus on the Hudson River in 2022, while OpenAI and Anthropic opened offices in the city. Amazon quietly expanded, opening a 2,000-employee office in Manhattan in 2023 and leasing an additional 330,000 square feet. However, the tech sector cannot fully compensate for lost finance jobs: as of August, New York hosted 84,000 computer-systems design employees—less than a quarter of the 383,000 in finance and insurance.

The Fiscal Squeeze

For city government, a leaner finance industry, fewer ultra-wealthy residents, and growing low-wage employment pose fundamental problems. No state spends more per capita on welfare and education than New York, which shelled out $9,761 per capita in 2022—72% more than Texas and 130% more than Florida. This generous welfare state was built on the tax revenue generated by finance and the ultra-rich.

Mamdani’s Platform and Challenges

Zohran Mamdani, who represents Astoria in the state assembly, has built a campaign around affordability: rent freezes, housing investment, free child care, and free buses. Polls and betting markets suggest he will very likely be elected mayor on November 4th, 2025. His appeal rests partly on weak opposition. The incumbent mayor, Eric Adams, sought re-election despite criminal indictment, while his main challenger, Andrew Cuomo, faces a persistent double-digit polling deficit.

Mamdani has benefited from the city’s deteriorating mood. Barely a third of New Yorkers rate their quality of life as good or excellent, down from just over half eight years ago. Only 27% rate government services well, down from 44%.

His most expensive proposal is providing free child care at up to $6 billion annually. He hopes to fund this by raising New York’s corporate tax to 11.5% (matching New Jersey) and levying an additional 2% income tax on those earning over $1 million. However, Governor Kathy Hochul has repeatedly said she will not allow tax increases, and such measures would likely accelerate departures of wealthy residents and businesses.

The Housing Crisis

Housing has become the city’s most pressing economic and political issue. Low-income New Yorkers increasingly struggle: households earning less than $70,000 now spend 54% of their income on rent, compared to less than 40% in 1991. High earners face similar pressures: earning $151,600 annually would be needed to afford a studio apartment while spending no more than 30% of gross income on rent—50% higher than Boston or San Francisco.

Mamdani has proposed freezing rents for roughly 1 million rent-stabilized apartments, which would benefit current residents but risk discouraging new construction and maintenance. His platform includes building 200,000 rent-stabilized apartments over ten years, triple the current rate. He also supports the “City of Yes” zoning amendments, which allow office-to-housing conversions and other liberalizations. Last year, 34,000 new apartments were built—the highest number in 60 years, though this was driven by developers chasing an expiring tax relief and unlikely to be repeated.

The Fiscal Reality

Mamdani faces immediate fiscal constraints. The next mayor will encounter an operating budget deficit of $6 billion to $8 billion. Medium-term pressures include federal Medicaid cuts that will cost New York state approximately $10 billion annually, eventually affecting the city’s public hospital system. The city’s current budget relies on $7.4 billion in federal funds, or 6.4% of the total, heavily concentrated in housing and education.

To realize his ambitious agenda, Mamdani will need state support and private investment, particularly for housing expansion. His recent statements suggest pragmatism: he has name-checked Michael Bloomberg and promises to appoint talented advisors. He acknowledges that affordable housing requires heavy private investment and says he would retain the current police commissioner.

Whether New York can reverse its economic trajectory depends on whether the city can generate new high-paying jobs while dramatically expanding housing supply. Without both, the city will become “a more economically ordinary American city—albeit one with extraordinary housing costs and a generous welfare system”—a far cry from its historical role as the nation’s financial capital.

La situación de las finanzas de New York no afectará la evolución de mercados financieros globales, no sucedió en los 1970’s. Como siempre, solo inviertan en ETF’s globales, no usen fondos peruanos porque son mucho más caros, tienen menores rentabilidades, mayor riesgo y su dinero está bloqueado por años. Los ETF’s tienen liquidez de 48 horas.

Lima 04 de Noviembre 2025

Francisco A. Delgado, PhD